Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

The Consumer Sentiment Index fell to a six-month low in May, dropping 9.1 percent month-to-month. Participants in the University of Michigan survey were:

They were wary about the outcome of debt ceiling discussions, concerned that policymakers will cause the United States to default on its debt, and apprehensive about how that could impact the economy, according to Director of Surveys Joanne Hsu.

What is the debt ceiling?

The debt ceiling is the amount of money the United States government is allowed to borrow to pay debts it has already incurred. These payments include interest on Treasuries, military salaries, Social Security and Medicare benefits, tax refunds, and other financial obligations. The debt ceiling has been lifted 78 times since 1960. Part of the reason that we have a debt ceiling is that both parties use it as leverage for their political agendas. Some points to consider:

What happens if policymakers don’t raise the debt ceiling?

No one knows for certain, although many economists, analysts, and the financial press are concerned. Here is what some have said:

…the U.S. federal government would face various unpalatable options, ranging from delaying payments to contractors, Social Security recipients, Medicare providers or agencies; to defaults on payments on US government debt.

Chris Giles and Colby Smith, Financial Times

A technical failure by the U.S. to meet its obligations would impact those Treasuries coming due most immediately. Bill markets are pricing in some risk of default in early June…A default threatens to spur big moves around the globe, with the prospect of a major economic downturn and a reassessment of Fed monetary policy potentially igniting a perverse bid for Treasury bonds on haven demand. Conversely, a resolution could shift the focus back to the outlook for inflation and the credit cycle for traders betting on whether the era of aggressive Fed interest-rate hikes has peaked.

Benjamin Purvis, Michael Mackenzie, and Ye Xie, Bloomberg

Potential repercussions of reaching the ceiling include a downgrade by credit rating agencies, increased borrowing costs for businesses and homeowners alike, and a drop off in consumer confidence that could shock the U.S. financial market and tip the economy into recession.

Noah Berman, Council on Foreign Relations

Many observers believe a deal will be reached before the June 1 deadline.

If you’re a long-term investor, there’s a strong case to do nothing. If history is a guide, a deal to avoid a default will be struck.

Lauren Foster, Barron’s

Last week, major U.S. stock indices finished the week with mixed performance, reported Barron’s. The Dow Jones Industrial Average and the Standard & Poor’s 500 Index lost value, while the Nasdaq Composite gained. The yield on the one-month Treasury bill finished the week 28 basis points higher than where it started.

Stocks fell for the second consecutive week. In the face of banking and economic concerns, stocks are holding the line. Stocks tend to lead the economy, so just because the economic headlines are poor now doesn’t mean they will be in the future.

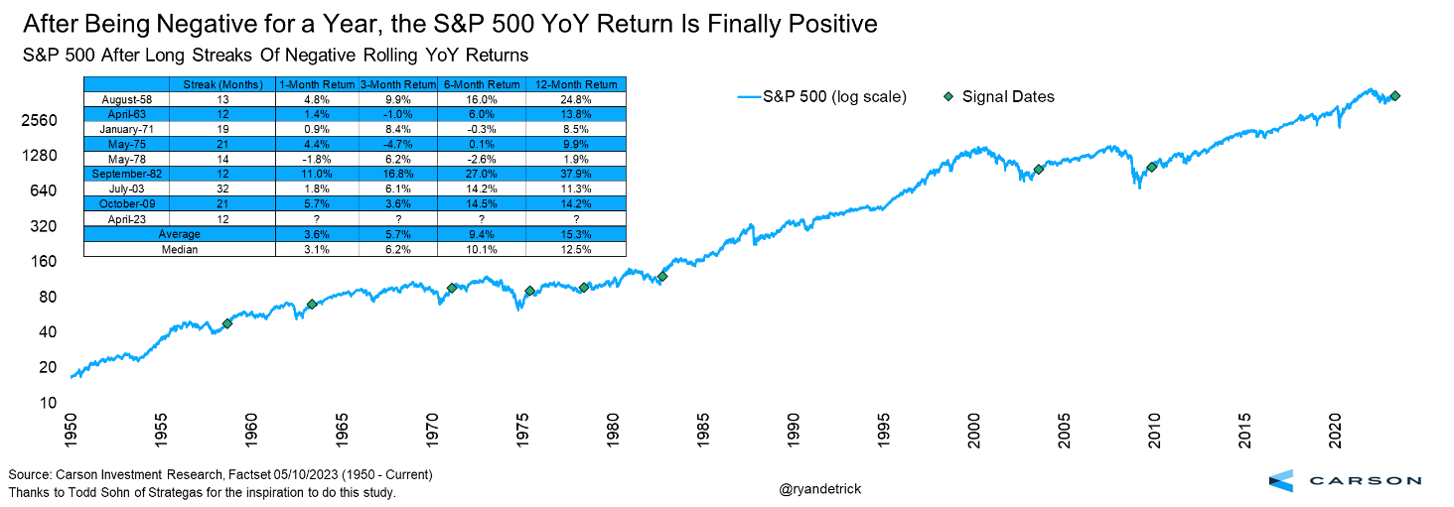

Stocks just turned positive on a year-over-year basis as of the end of April. This matters as the S&P 500 had a negative year-over-year return for 12 months in a row before finally turning positive last month. We reviewed previous examples of the stock market going at least 12 months with negative year-over-year returns, and sure enough the future returns could be positive.

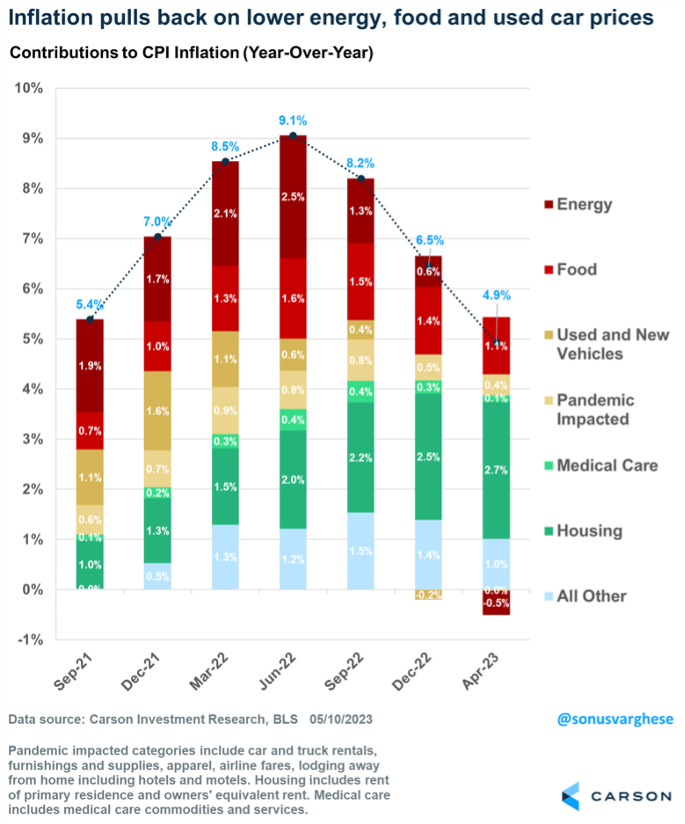

April’s CPI inflation data came in at expectations. Headline inflation rose 0.4% and is now up 4.9% over the past year. That is well below the peak rate of 9.1% last June. The big picture is inflation has already pulled back in a big way. That is primarily because of lower energy prices and a welcome decrease in food prices. Used car prices rose in April but have been on a downtrend since last summer, contributing to the pullback in inflation. New car price inflation appears to be easing now, too.

Excluding food and energy, core inflation is now running higher than headline inflation, at 5.5% over the past year. That’s not far below last summer’s peak of 6.6%, and so the pullback in headline inflation hasn’t quite translated to the core measure. Core inflation is also what the Federal Reserve typically focuses on, and from that perspective, inflation remains well above the Fed’s target 2% rate.

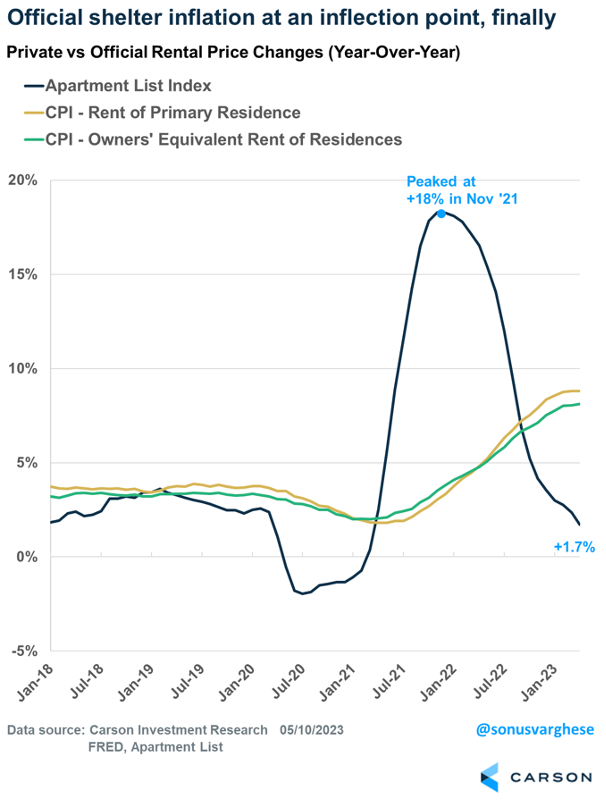

The main reason behind elevated core CPI inflation is housing inflation, which makes up 41% of the basket. Housing inflation, which is basically derived from rents (as opposed to home prices), has been running hot, around 8-9% over the past year.

This is in sharp contrast to market-based rental price measures, which have shown a sharp deceleration in rents over the past year. Apartment List’s national rental index peaked at 18% about 18 months ago, but that has decelerated to a 1.7% pace as of April. The official shelter index clearly has a significant lag to this market-based index. But here’s the good news: The official data looks to be at a turning point.

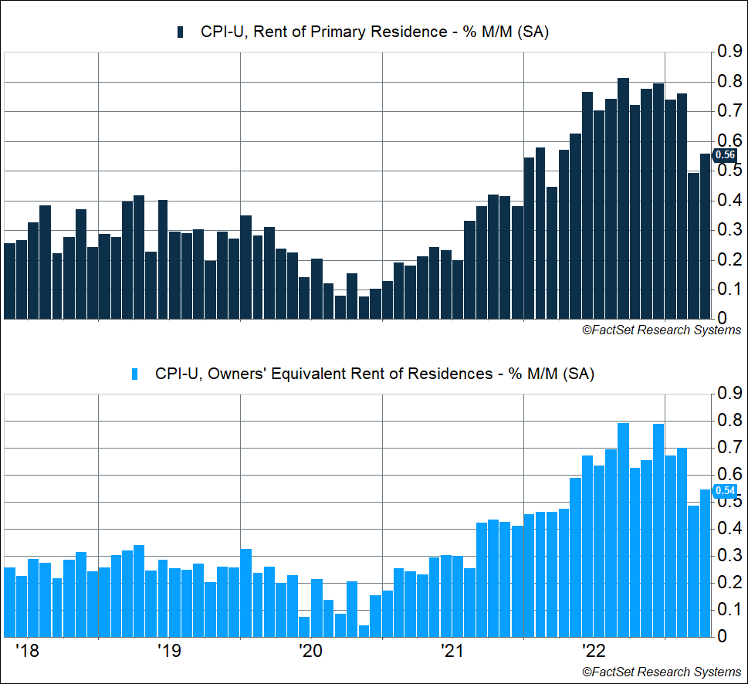

On a month-over-month basis, rents had been increasing at an average rate of more than 0.7% between June 2022 and February 2023. But that has decelerated to an average rate of about 0.5% over the last two months, which is a very positive sign. However, as the chart below shows, that’s still higher than 2018-2019 when monthly increases averaged about 0.3%.

In short, the official housing inflation data is decelerating, but there’s still some ways to go. We’re likely to get closer to the pre-pandemic pace as we move into the second half of 2023, and that will also pull core inflation lower. That would be more than welcome, especially since it should ease the Fed’s concerns about inflation running above target.

Since its post-pandemic re-opening, the Chinese economy has been recovering more slowly than many companies and investors anticipated, but there’s one industry that’s red hot: food tourism. Domestic tourists have been flocking to a small industrial city that has become the epicenter of a national obsession with grilling.

Thousands of tourists have been traveling to the central province of Shandong to experience grilled kebabs and taking pictures of the experience for social media. The skewers are cooked, flattened and dipped in garlic chili paste before being coated in sesame seeds and peanuts. According to The Economist, crowds have been so large that arenas are being remade into temporary dining halls, and banks are issuing low-interest loans to support companies in grilling-related industries.

The great grilling frenzy highlights a social media trend that’s currently popular among young people in China: Special-Forces tourism. The mission of these tourists is the experience – find and eat tasty food while forgoing sleep and spending as little time and money as possible. Some travel to more than 10 locations in a single day. Kebabs and a local beer hit the sweet spot for special-forces tourists. Altogether, the meal and drink cost hungry travelers about $0.40 in US dollars.

May 16, 1929: First Academy Awards Ceremony

On May 16, 1929, the Academy of Motion Picture Arts and Sciences handed out its first awards, at a dinner party for around 250 people held in the Blossom Room of the Roosevelt Hotel in Hollywood, California.

Created by Louis B. Mayer, head of the powerful MGM film studio, the Academy was organized in May 1927 as a non-profit organization dedicated to the advancement and improvement of the film industry. Its first president and the host of the May 1929 ceremony was the actor Douglas Fairbanks, Sr. Unlike today, the winners of the first Oscars—as the coveted gold-plated statuettes later became known—were announced before the awards ceremony itself.

The Academy officially began using the nickname Oscar for its awards in 1939; a popular but unconfirmed story about the source of the name holds that Academy executive director Margaret Herrick remarked that the statuette looked like her Uncle Oscar. Since 1942, the results of the secret ballot voting have been announced during the live-broadcast Academy Awards ceremony using the sealed-envelope system. The suspense—not to mention the red-carpet arrival of nominees and other stars wearing their most beautiful or outrageous evening wear—continues to draw international attention to the film industry’s biggest night of the year.

Don’t count the days. Make the days count.

Muhammad Ali, Boxer

It ain’t no sin to be glad you’re alive.

Bruce Springsteen, Singer

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources: http://www.sca.isr.umich.edu https://home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/debt-limit https://www.ft.com/content/7b523066-9b1a-4a91-8912-48983557eaf2 https://www.bloomberg.com/news/articles/2023-05-13/bond-traders-laser-focused-on-washington-as-debt-cap-risks-grow https://www.cfr.org/backgrounder/what-happens-when-us-hits-its-debt-ceiling https://www.barrons.com/articles/debt-ceiling-mess-investing-fed-treasuries-9d5f90cc https://www.barrons.com/market-data?mod=BOL_TOPNAV https://www.history.com/this-day-in-history/first-academy-awards-ceremony https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202305 https://www.reuters.com/business/big-us-firms-adopt-cautious-tone-china-recovery-2023-05-10/ https://www.carsonwealth.com/insights/blog/market-commentary-hanging-tough/?utm_source=sfmc&utm_medium=email&utm_campaign=weekly-market-commentary&j=2238153&sfmc_sub=110820205&l=380_HTML&u=31400399&mid=100016897&jb=3005 https://www.economist.com/finance-and-economics/2023/05/11/the-meaty-mystery-at-the-heart-of-chinas-economic-growth https://news.cgtn.com/news/2023-05-04/-Special-Forces-style-Tourism-the-latest-fad-for-Chinese-youths-1jwTVxcZfCo/index.html https://www.goodreads.com/author/quotes/5662.Ruth_Reichl

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: