Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

Investors are willing to take on risk to achieve their long-term financial goals, but not everyone manages risk in the same way. Some people are willing to embrace risk, and others prefer a less adventurous option. It is impossible to completely eliminate the risks associated with investing, it is possible to manage investment risk with asset allocation, diversification, and other strategies.

Last week, investors responded to the uncertainty created by bank closures in a variety of ways. Some sold assets they felt had too much risk for the current market environment, opting for sectors and industries that have historically shown resilience during economic slowdowns. Others snapped up investments at discounted prices, reported Ryan Ermey of CNBC. Some investors did nothing.

The smartest thing to do when you have a lot of uncertainty is to sit back and gather information and do your analysis and not jump trying to make big changes.

Source cited by Lu Wang and Isabelle Lee, Bloomberg

Uncertainty is likely to persist as economists and analysts assess how the American economy may be affected.

Banking panics aren’t something to be trifled with. As Fed Chairman Jerome Powell acknowledged on Wednesday, the latest one is sure to slow the economy…The problem, however, isn’t the possibility of more bank failures. It’s that banks are likely to curtail lending—lending they had already started to limit.

Ben Levisohn, Barron’s

As bank lending tightens, economic growth in the United States will probably slow. When it becomes more difficult for households and businesses to get credit, consumer spending tends to fall. Since consumer spending is the primary driver of economic growth in the U.S., the economy is likely to be affected and we may enter a recession, reported Rich Miller of Bloomberg.

Major U.S. indices finished the week higher, while U.S. Treasury yields rose before retreating again.

In the midst of a banking crisis, that has seen some of the largest U.S. banks collapse nearly overnight, and 100-year-old European banks verging on failure, not to mention a volatile bond market and a plunge in crude oil — the Federal Reserve raised rates. While many expected stocks to tumble in the face of such headwinds, it hasn’t happened.

In fact, the S&P 500 has officially gained over the past two weeks despite the banking drama. How could this be? There are certainly more questions than answers right now, and yes, the odds of a recession have increased as banks will tighten lending, which could lead to an economic slowdown. Still, economic data is improving. Housing data is rallying, manufacturing is showing signs of a low, and the consumer is demonstrating incredible resilience.

One of the best reasons to be bullish is very few people are. Recent sentiment polls show a high number of bears while worries about the economy and earnings continue to expand. Why is this a good thing? Think back to March 2003, March 2009, and March 2020. Those were all scary times; yet, stocks made major lows in those years. In 2003, the war in Iraq started after a three-year bear market; the global financial crisis was underway in 2009 and stocks dropped by half; and in 2020 the world shut down due to COVID-19. None of these periods felt like good times to look to a brighter future, but they were.

When investors are bearish, few sellers remain. That means any good news could spark a rally. Potential sparks this time: an increase in FDIC insurance; a Fed that is nearly done hiking; inflation continuing to come back to Earth; stronger earnings from corporate America; a consumer that continues to drive the economy; and the recent banking crisis not expanding past a few badly positioned banks.

Although it might not feel like it, there are many reasons to expect stocks to bounce back and markets to improve.

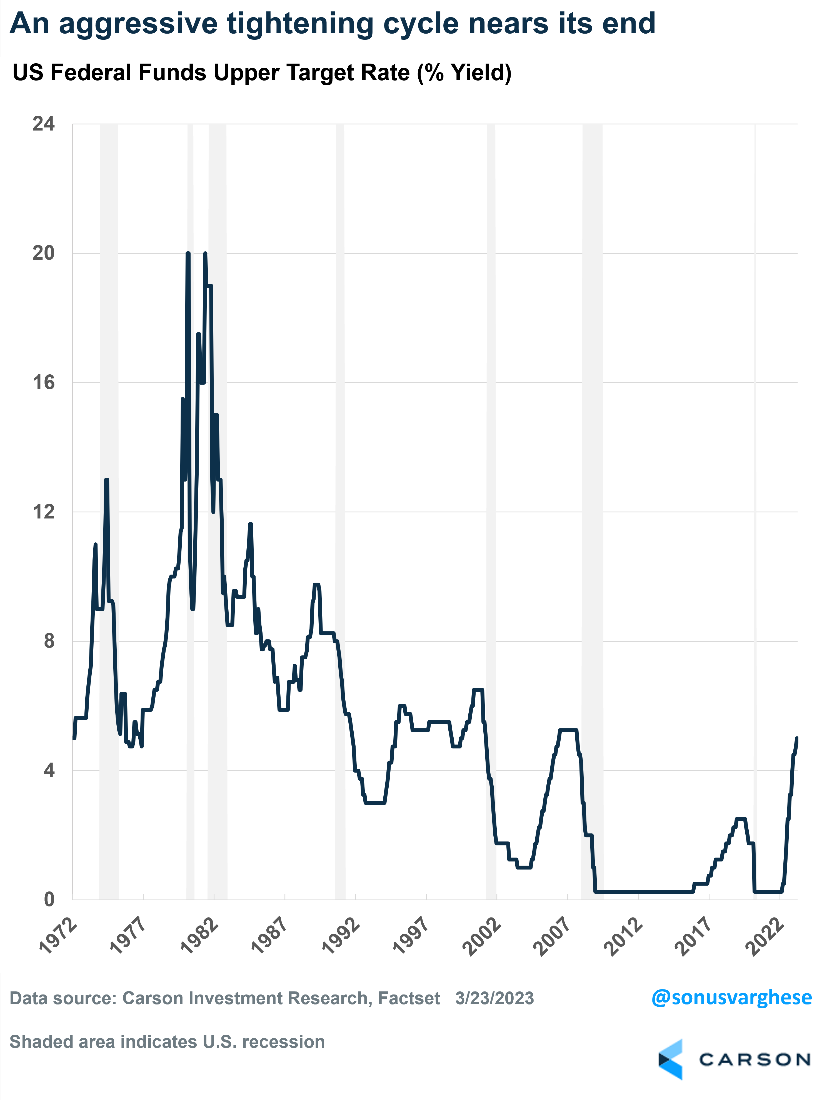

The Federal Reserve raised the federal funds rate by 0.25% at its March meeting, bringing it to the 4.75-5.0% range. This is the ninth straight rate increase and brings rates to their highest level since 2007. However, the most aggressive tightening cycle since the early 1980s, during which the Fed lifted rates from near zero to almost 5%, may be near its end.

Up until early February, Fed officials expected to raise rates to a maximum of about 5.1% and hold them there for a while. However, since that time a slew of strong economic data, including elevated inflation numbers, came in. This pushed Fed officials to give “guidance” that they expected to raise rates by more than they estimated in December.

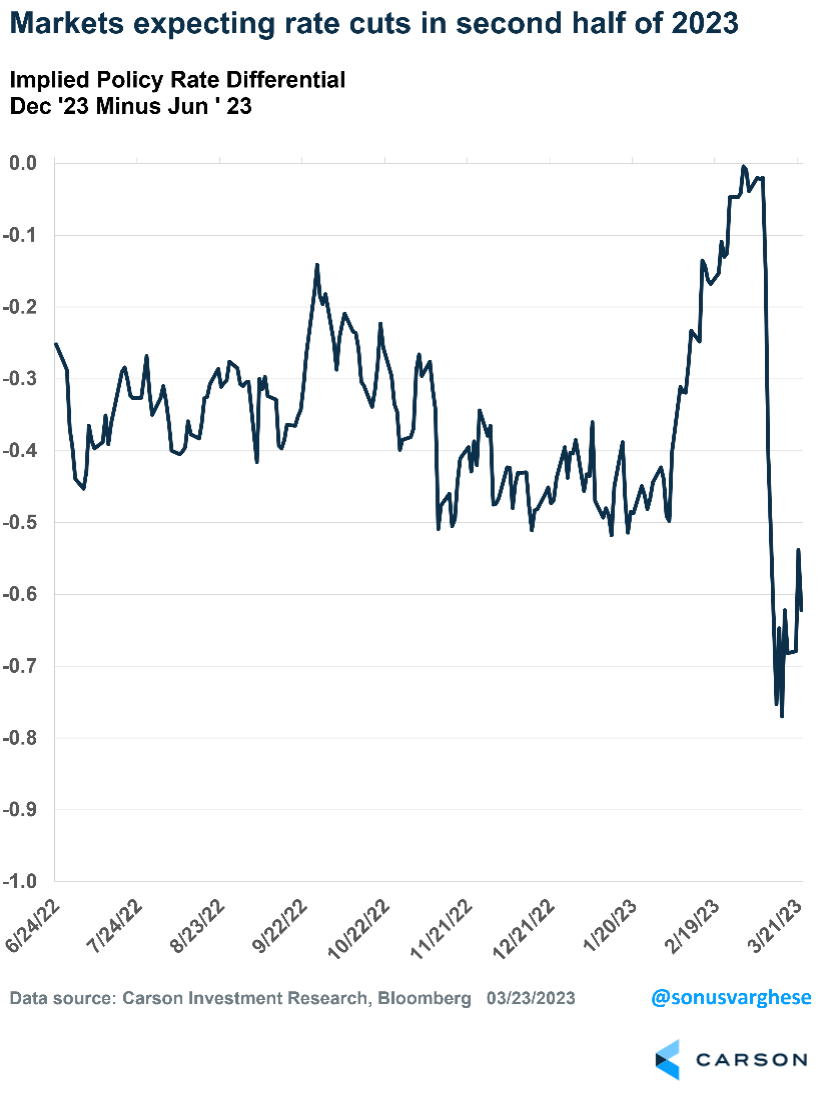

Market expectations for policy moved accordingly. Prior to February, markets expected the Fed to raise rates to 5% by June and subsequently lower them by about 0.5% by the end of the year. But strong incoming data and Fed guidance pushed expectations higher, with the terminal rate moving up to 5.6% and no cuts in 2023.

The Silicon Valley Bank Crisis Changed Everything

The bank crisis that erupted over the last couple of weeks resulted in a significant shift, both in expectations for policy and the Fed’s actions. See here for our complete rundown on SVB and the ensuing crisis.

Market expectations for Fed policy rates immediately moved lower. Markets expected the stress in banks to translate to tighter credit conditions, which in turn would lead to slower economic growth and lower inflation.

Fed Chair Jerome Powell spoke similarly after the Fed’s March meeting. The 0.25% increase was an attempt to thread the needle between financial stability and fighting inflation. Fed officials also forecast the fed funds rate to hit a maximum of 5.1%, unchanged from their December estimate. This is a marked shift from what was expected just a few weeks ago, with Powell explicitly saying that tighter credit conditions “substitute” for rate hikes.

While the recent bank stresses are expected to tighten credit conditions, and thereby impact economic growth and inflation, a couple questions remain:

These are unknown currently, which means future policy is also unknown. Fed officials expect to take rates to 5.1%, i.e., one more rate increase. And they expect to hold it there through the end of the year. In short, they don’t expect rate cuts this year.

Yet, investors expect no more rate increases and about 0.6% of rate cuts in the second half of 2023. Markets expect the policy rate in June to be at 4.8%, while expectations for December are at 4.2%.

There is a huge gulf between what the Fed expects and what investors expect. This will have to reconcile in one of two ways:

Events will not unfold in a straight line. It will be a bumpy ride as new data points come in, not to mention news and rumors of renewed problems in the banking sector.

When the dangers of secondhand smoke were confirmed, an early solution in many restaurants was the no-smoking section. Now, researchers report that emotions may be contagious. When an expressive friend, family member or stranger shows emotion, it can influence the mood of those around them.

In other words, exposure to positive emotions can invoke happiness and goodwill in others, while negative emotions may spread stress and anxiety.

Over the past decade, we have learned how our brains are hardwired for emotional contagion. Emotions spread via a wireless network of mirror neurons, which are tiny parts of the brain that allow us to empathize with others and understand what they’re feeling…if someone in your visual field is anxious and highly expressive — either verbally or non-verbally — there’s a high likelihood you’ll experience those emotions as well, negatively impacting your brain’s performance.

Shawn Achor and Michelle Gielan, Harvard Business Review

Here's an interesting sidenote: stress can spread by scent, too.

No matter how stress is triggered, there are actions you can take to keep from being overwhelmed by secondhand stress and anxiety. These include:

The research has important implications for the workplace and the home.

The deadline to make 2022 contributions to your IRA or Roth IRA is April 18, 2023. The total contributions that you can make annually to these accounts cannot be more than the following:

If you have already contributed the maximum amount allowed for 2022, the total contributions that can be made in 2023 are:

If you are unsure of how much you have contributed to your IRA or Roth IRA for the year 2022, or would like assistance in opening one of these accounts, please contact us.

March 27, 1912: Japanese Cherry Trees Planted Along the Potomac

In Washington, D.C., Helen Taft, wife of President William Taft, and the Viscountess Chinda, wife of the Japanese ambassador, planted two Yoshino cherry trees on the northern bank of the Potomac River, near the Jefferson Memorial. The event was held in celebration of a gift, by the Japanese government, of 3,020 cherry trees to the U.S. government.

In January 1910, 2,000 Japanese cherry trees arrived in Washington from Japan but had fallen prey to disease during the journey. In response, a private Japanese citizen donated the funds to transport a new batch of trees, and 3,020 trees were taken from the famous collection on the bank of the Arakawa River in Adachi Ward, a suburb of Tokyo. In March 1912, the trees arrived in Washington, and on March 27 the first two trees were planted along the Potomac River’s Tidal Basin in a formal ceremony. The rest of the trees were then planted along the basin, in East Potomac Park, and on the White House grounds.

The blossoming trees proved immediately popular with visitors to Washington’s Mall area, and in 1934 city commissioners sponsored a three-day celebration of the late March blossoming of the trees, which grew into the annual Cherry Blossom Festival. After World War II, cuttings from Washington’s cherry trees were sent back to Japan to restore the Tokyo collection that was decimated by American bombing attacks during the war.

For every minute you are angry you lose sixty seconds of happiness.

Ralph Waldo Emerson, Philosopher

If you are lonely when you are alone, then you are in bad company.

Jean-Paul Sartre, Playwright

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

https://www.finra.org/investors/investing/investing-basics/risk

https://www.cnbc.com/2023/03/23/why-analysts-say-banks-will-be-fine.html

https://www.bloomberg.com/news/articles/2023-03-24/freezing-in-shock-is-working-pretty-well-in-stressed-out-markets

https://www.barrons.com/articles/the-stock-market-keeps-gaining-the-risks-keep-building-cb466d1?mod=hp_columnists

https://www.bloomberg.com/news/articles/2022-11-21/us-banks-tighten-lending-standards-raising-risk-of-recession#xj4y7vzkg

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-6143c6d0?refsec=the-trader&mod=topics_the-trader

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202303

https://www.carsonwealth.com/insights/market-commentary/market-commentary-stocks-are-quite-resilient/?utm_source=sfmc&utm_medium=email&utm_campaign=weekly-market-commentary&j=2145392&sfmc_sub=110820205&l=380_HTML&u=29945727&mid=100016897&jb=1006

https://link.springer.com/article/10.1007/BF00987285

https://www.history.com/this-day-in-history/japanese-cherry-trees-planted-along-the-potomac

https://hbr.org/2015/09/make-yourself-immune-to-secondhand-stress

https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0077144

https://www.goodreads.com/quotes/tag/happiness

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: