Stay up-to-date.

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here:

Human-Centric Wealth Management™

So far this year, the direction of the economy and financial markets has been elusive.

Is inflation headed in the right direction? Inflation changed course late in 2022. The monthly change in the rate of inflation, as measured by the PCE Core Price Index (one of the Federal Reserve’s preferred inflation gauges) accelerated late in 2022 and continued to move higher in January 2023. Then, it slowed in February, creating uncertainty about the state of inflation.

The latest University of Michigan Consumer Sentiment Survey indicated that Americans expect inflation to fall over the coming year and over the longer term. That’s important because there is a psychological aspect to inflation. When people expect inflation to rise, they spend more, which can push inflation higher.

If inflation is trending lower, then it gives weight to the opinion of investors who are optimistic the Fed will reverse course this year.

Will rate hikes continue or pause? Amid persistent inflation, the Federal Reserve delivered the message that rates might go higher than expected and stay there longer than expected. Then three banks failed, and speculation that the Fed would slow the pace of rate increases began.

The challenge for the Fed is figuring out how to buttress banks and cool inflation at the same time, without triggering a recession.

Megan Cassella of Barron’s

The Fed raised rates in March, despite turmoil in the banking sector. Treasury yields fell across much of the yield curve following the rate hike. Yields moved higher last week, which suggests that bond investors may anticipate further rate hikes.

While many investors appear to be optimistic that the Fed will take a breather on rate hikes, Fed projections suggest it will continue to raise rates in 2023, although it may ease in 2024.

Are we headed for a recession? It’s a question that economists and analysts have been trying to answer for more than a year as central banks in the U.S., Europe, and elsewhere raised rates aggressively. Last week, Bloomberg’s survey of economists found the probability of a recession over the next 12 months was 65 percent, up from 60 percent in February.

“After the Fed last week raised rates a quarter percentage point to the highest since 2007, economists worry not only about the impact on demand but the effect on the banking system…Financial institutions risk becoming more guarded in their lending approach, restricting access to capital needed by businesses to expand and consumers to buy homes, cars and other big-ticket items,” reported Augusta Saraiva and Kyungjin Yoo of Bloomberg.

While the odds of recession crept higher last week, not everyone agrees that a recession is ahead.

Is the economy weakening or strengthening? We’ve seen strong jobs growth, yet the unemployment rate has risen as labor force participation increased. In addition, business activity was up sharply in March 2023.

U.S. companies signaled a renewed expansion in business activity in March...Output grew at a solid pace that was the fastest since May 2022 as demand conditions improved and new order growth returned. Manufacturers and service providers alike registered upturns in output, with service sector firms driving the increase.

S&P Global Flash US Composite PMI™

The economic tea leaves have not provided a definitive answer about the strength and direction of the economy.

Despite all of the uncertainty, stock investors were optimistic last week, and major U.S. stock indices rose, reported Nicholas Jasinski of Barron’s. The Treasury market headed in the other direction as rates across most maturities of Treasuries rose and bond prices fell.

Basic principles of investing such as asset allocation, diversification and portfolio rebalancing remain sound.

In the end, stocks had a solid gain in the first quarter. The S&P 500 Index climbed 7.5%, including dividends. But it sure wasn’t easy. After being up more than 8% for the year in mid-February, stocks pulled back sharply, due in part to the banking crisis that took place the second week of March. Meanwhile, the banking crisis appears to be fading and isolated to a few companies that made some very poor decisions.

Looking forward in 2023, volatility likely will remain. Overall market sentiment is historically low, and while investors have been concerned about a recession for more than a year, the economy continues to surprise to the upside, led by a strong consumer. The masses are often wrong, which suggests that with so many bears out there, the path could remain upward for stocks.

Certainly, there are still concerns. But whether it’s inflation, the banking crisis, a Federal Reserve policy mistake, a global event, or something else that no one sees coming, worries are part of investing. We believe the positives outweigh the negatives. The Fed seems to be nearly done hiking rates, inflation continues to sink, global manufacturing is rebounding, China continues to reopen, and the employment picture remains healthy.

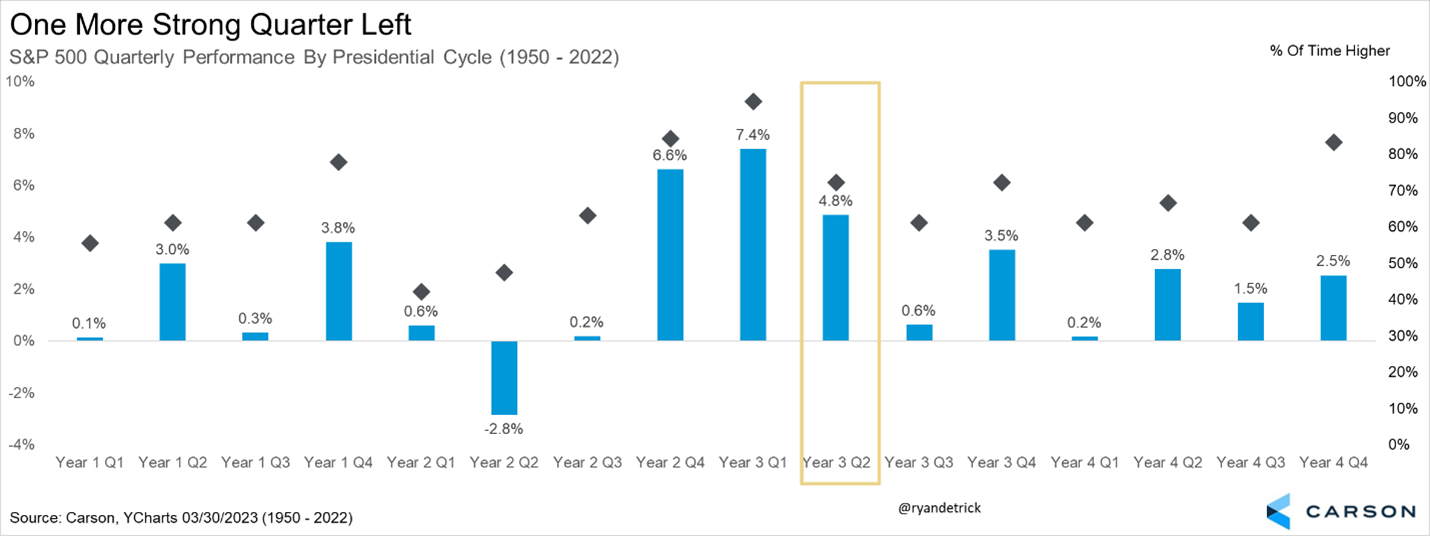

Market performance during the four-year presidential election cycle shows that this quarter is historically quite strong, as are the previous two quarters. The S&P 500 Index added 7.6% in the fourth quarter last year and another 7.5% last quarter, so the trend is playing out well so far. We would never invest blindly based on seasonality, but this could bode well for a continuation of the surprise spring rally.

The biggest positive going for the economy is employment. Payroll growth has averaged just more than 350,000 over the past three months, and the unemployment rate is 3.6%, close to 50-year lows. Weekly initial claims for unemployment benefits remain low, suggesting employment growth continues to run strong.

Nevertheless, when discussions of the labor market arise, tech sector layoffs loom disproportionately large. The companies making these announcements saw payrolls surge after the pandemic, and now they’re retrenching.

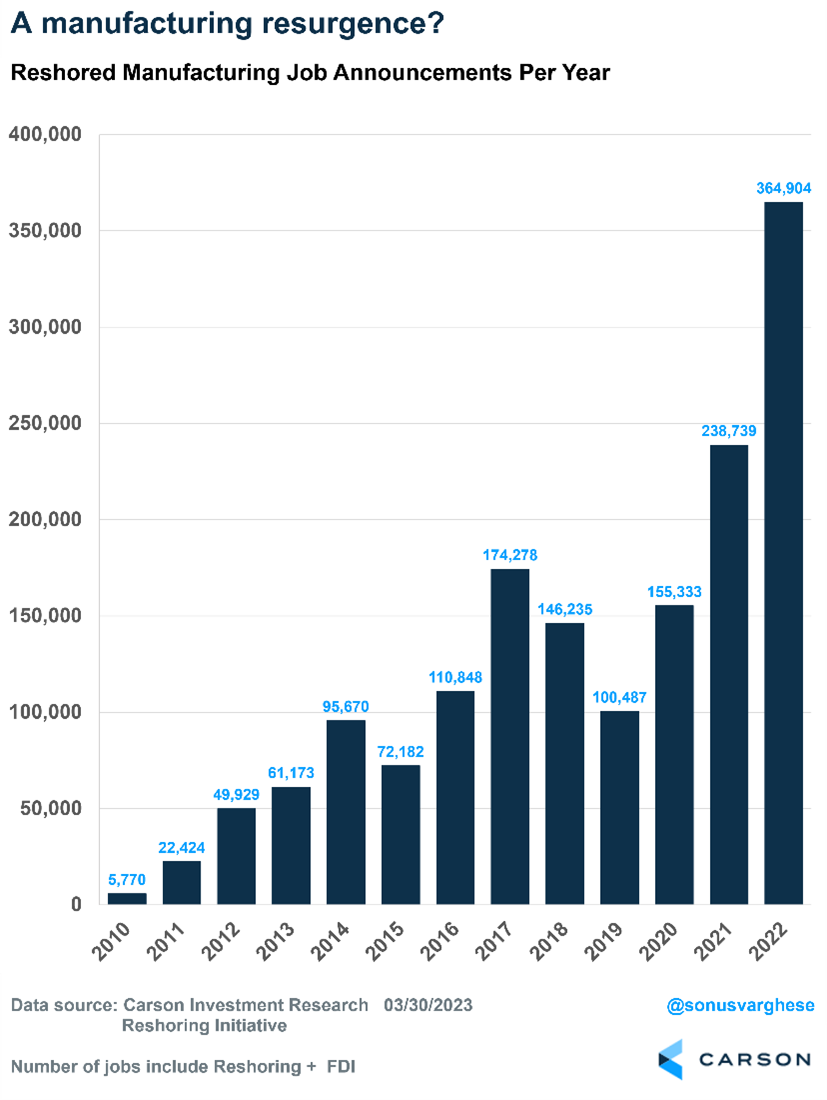

Here’s something else that gets lost in the negative headlines. As good as the labor market is right now, American companies re-shored a record 365,000 manufacturing jobs in 2022. Reported by the Reshoring Initiative, this includes jobs that had previously been held in other countries and jobs created by foreign-owned companies in the U.S.

The 2022 number is a 53% increase from 2021, which itself saw a 54% increase from 2020. These numbers are typically volatile, but the sheer magnitude of the increase suggests the making of a trend.

The report points out that the increase was driven by a surge in electric vehicle batteries and chips, along with a continued uptrend in industries around electrical equipment, chemicals, transportation equipment, and medical equipment.

The increase from 2020-2022 was partly due to companies recognizing that supply chains extending across the world are vulnerable to disruptions and geopolitical events.

The other reason is manufacturing investment in the U.S. is surging after Congress and the president passed last year’s Inflation Reduction Act (IRA) and the Chips and Science Act. We wrote at the time that the IRA was poorly labeled, but it was a big deal and included:

This could potentially incentivize investment in technology and increase productivity, which would be good for workers, let alone economic growth and corporate profits.

Manufacturing Construction is Booming

The construction industry has clearly taken a hit from the Federal Reserve’s aggressive interest rate hikes. Mortgage rates surged as a result, and that froze homebuying activity. Single-family housing starts collapsed 32% year-over-year in February 2023. Multi-family housing is holding on, but that’s because many units remain under construction and rental demand is high thanks to low housing inventory.

Since the banking crisis, commercial real estate has come under the microscope. Small banks make a lot of loans to this sector, and a pullback in lending will hurt. But commercial and office construction had already been slowing before the crisis.

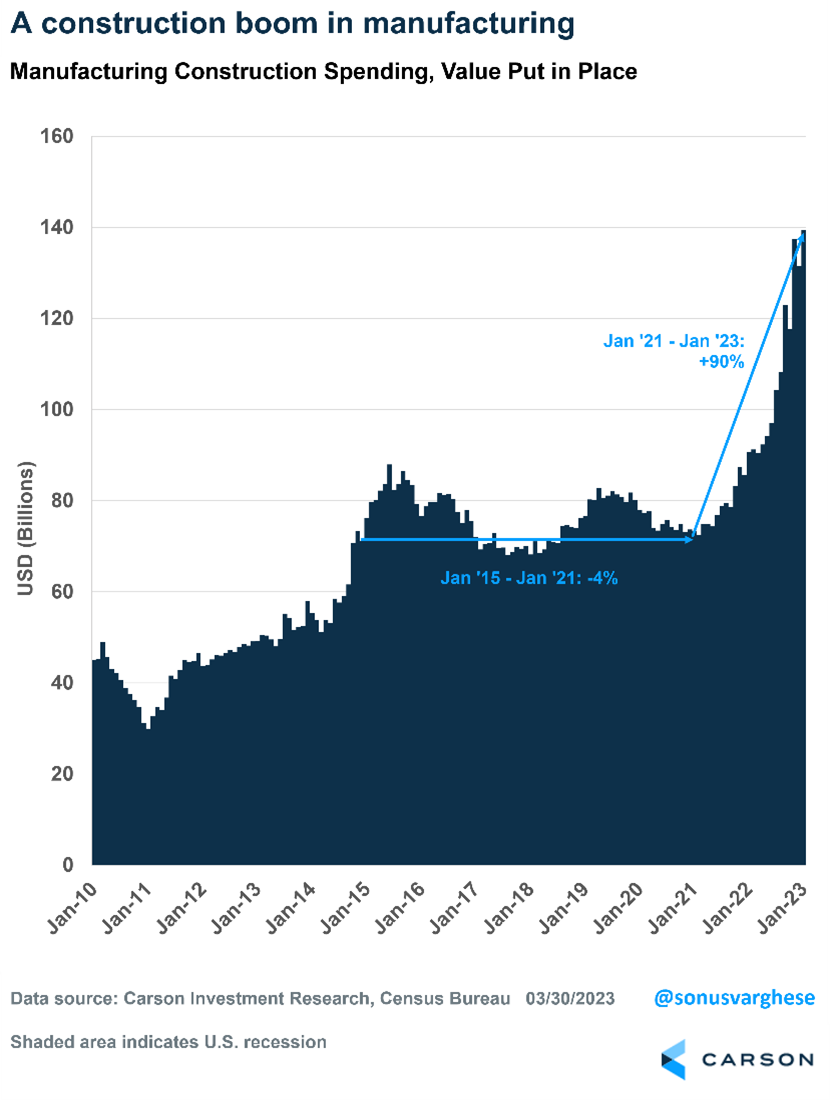

The total dollar value of all private construction spending rose about $61 billion over the year through January, representing a 4.4% year-over-year increase. Of this, almost $49 billion came from manufacturing construction spending.

As of January, manufacturing construction spending in dollar terms is up 54% year-over-year, and it is up 90% from two years ago.

A year ago (January 2022) manufacturing construction made up about 6.5% of total private construction in the U.S. It’s risen to almost 10% (January 2023).

This is almost entirely driven by the computers and electronics industry and includes investment in semiconductor plants, where construction spending is up 158% year-over-year and a whopping 723% over the last two years!

Construction spending across the rest of the manufacturing industry is up 17% year-over-year. Not too shabby by itself, but it pales in comparison to what’s happening on the computers and electronics side.

Of course, much of this growth is driven by subsidies and tax credits, which are not going to continue year after year. But investment spending tends to feed on itself, especially since it can boost productivity. That’s potentially a huge positive for the U.S. economy over the next decade.

Sometimes it helps to pull back and look at the bigger, longer-term economic picture.

Tax Day is almost here – it’s April 18 this year. If you’re retired or planning for retirement, it’s important to know that some states are more tax-friendly for retirees than others. Typically, in tax-friendly states, Social Security benefits are exempt from state tax and pension payments and/or IRA withdrawals may receive more favorable state tax treatment. David Muhlbaum and Rocky Mengle, Kiplinger

Our results are based on the estimated state and local tax burden in each state for two hypothetical retired couples with a mixture of income from wages, Social Security, traditional IRAs, Roth IRAs, private pensions, 401(k) plans, interest, dividends, and capital gains. One couple had $50,000 in total income and a $250,000 home, while the other had $100,000 in income and a $350,000 home.

David Muhlbaum and Rocky Mengle, Kiplinger

The most tax-friendly states were:

The least tax-friendly were:

When you’re deciding where to settle in retirement, there’s a lot more to consider than taxes. Family, friends, cost of living and weather also are key considerations. Weather is becoming more important as the number and intensity of natural disasters has been increasing, raising the cost of insurance significantly in some places, reported Kate Dore of CNBC.

The deadline to make 2022 contributions to your IRA or Roth IRA is April 18, 2023. The total contributions that you can make annually to these accounts cannot be more than the following:

If you have already contributed the maximum amount allowed for 2022, the total contributions that can be made in 2023 are:

If you are unsure of how much you have contributed to your IRA or Roth IRA for the year 2022, or would like assistance in opening one of these accounts, please contact us.

April 4, 1975: Microsoft Founded

On April 4, 1975, at a time when most Americans used typewriters, childhood friends Bill Gates and Paul Allen founded Microsoft, a company that makes computer software.

Gates and Allen started Microsoft—originally called Micro-Soft, for microprocessors and software—in order to produce software for the Altair 8800, an early personal computer. Allen quit his job as a programmer in Boston and Gates left Harvard University, where he was a student, to focus on their new company, which was based in Albuquerque because the city was home to electronics firm MITS, maker of the Altair 8800. By the end of 1978, Microsoft’s sales topped more than $1 million and in 1979 the business moved its headquarters to Bellevue, Washington, a suburb of Seattle, where Gates and Allen grew up.

In 1985, Microsoft released a new operating system, Windows, with a graphical user interface that included drop-down menus, scroll bars and other features. The following year, the company moved its headquarters to Redmond, Washington, and went public at $21 a share, raising $61 million. By the late 1980s, Microsoft had become the world’s biggest personal-computer software company, based on sales. In 1995, amidst skyrocketing purchases of personal computers for home and office use, Windows 95 made its debut.

Love your enemies, for they tell you your faults.

Ben Franklin, Polymath

They throw you a round ball and give you a round bat and tell you to hit it squarely.

Ted Williams, Baseball Player

Investment advisory services offered through SPC Financial® (SPC). *Tax services and analysis are provided by the related firm, Sella & Martinic (S&M), through a separate engagement letter with clients. SPC and S&M do not accept orders and/or instructions regarding your investment account by email, voicemail, fax or any alternative method. Transactional details do not supersede normal trade confirmations or statements.

Email through the Internet is not secure or confidential. SPC and S&M reserve the right to monitor all email. Any information provided in this message has been prepared from sources believed to be reliable, but is not guaranteed by SPC or S&M, their owners or employees, and is not a complete summary or statement of all available data necessary for making a financial decision.

Any information provided is for informational purposes only and does not constitute a recommendation. SPC and S&M, including their owners or employees may own securities mentioned in this email or options, rights, or warrants to purchase or sell these securities.

SPC does not provide tax or legal advice. Before making a legal, investment, or tax decision, contact the appropriate professional. Any tax information or advice contained in this message is confidential and subject to the Accountant/Client Privilege.

This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination, or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please notify the sender and delete the material from your computer immediately. SPC and S&M shall not be liable for the improper or incomplete transmission of the information contained in this communication or for any delay in its receipt or damage to your system.

Portions of this newsletter were prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with SPC or S&M. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is not intended as a solicitation of an offer to buy, hold, or sell any security referred to herein. There is no assurance any of the trends mentioned will continue in the future.

Any expression of opinion is as of this date and is subject to change without notice. Opinions expressed are not intended as investment advice or to predict future performance. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Past performance does not guarantee future results. Investing involves risk, including loss of principal. Consult your financial professional before making any investment decision. Stock investing involves risk including loss of principal. Diversification and asset allocation do not ensure a profit or guarantee against loss. There is no assurance that any investment strategy will be successful.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as "The Dow" is an index used to measure the daily stock price movements of 30 large, publicly owned U.S. companies. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system.

The MSCI ACWI (All Country World Index) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. As of June 2007, the MSCI ACWI consisted of 48 country indices comprising 23 developed and 25 emerging market country indices. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

The Bloomberg Barclays US Aggregate Bond Index is a market capitalization-weighted index, meaning the securities in the index are weighted according to the market size of each bond type. Most U.S. traded investment grade bonds are represented.

Please note, direct investment in any index is not possible. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Third-party links are being provided for informational purposes only. SPC and S&M are not affiliated with and do not endorse, authorize, sponsor, verify or monitor any of the listed websites or their respective sponsors, and they are not responsible or liable for the content of any website, or the collection or use of information regarding any website's users and/or members. Links are believed to be accurate at time of dissemination, but we make no guarantee, expressed or implied, to the accuracy of the links subsequently.

This may constitute a commercial email message under the CAN-SPAM Act of 2003. If you do not wish to receive marketing or advertising related email messages from us, please click the “unsubscribe” link within this email message. You will continue to receive emails from us related to servicing your account(s).

Sources:

https://etc.usf.edu/lit2go/221/the-story-of-doctor-dolittle/5624/chapter-10-the-rarest-animal-of-all/

https://www.bea.gov/news/2023/personal-income-and-outlays-february-2023

http://www.sca.isr.umich.edu

https://www.investopedia.com/terms/i/inflationarypsychology.asp

https://www.cnbc.com/2023/03/07/fed-chair-powell-says-interest-rates-are-likely-to-be-higher-than-previously-anticipated.html

https://www.barrons.com/articles/fed-rates-inflation-bank-crisis-recession-4533213c?mod=Searchresults

https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value_month=202303

https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230322.pdf

https://www.carsonwealth.com/insights/market-commentary/market-commentary-the-first-quarter-ends-on-a-high-note/?utm_source=sfmc&utm_medium=email&utm_campaign=weekly-market-commentary&j=2156484&sfmc_sub=110820205&l=380_HTML&u=30133463&mid=100016897&jb=3006

https://www.bloomberg.com/news/articles/2023-03-28/economists-boost-us-recession-odds-on-higher-rates-banking-woes

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.pmi.spglobal.com/Public/Home/PressRelease/53e9f887b83e47d7bc6681c608d5aa3f

https://www.barrons.com/articles/stock-market-dow-nasdaq-s-p-500-banks-fed-55ec13cd?refsec=the-trader&mod=topics_the-trader

https://www.kiplinger.com/retirement/601814/most-tax-friendly-states-for-retirees

https://www.kiplinger.com/retirement/601815/least-tax-friendly-states-for-retirees

https://www.history.com/this-day-in-history/microsoft-founded

https://www.cnbc.com/2022/08/07/climate-change-is-making-some-homes-too-costly-to-insure.html

https://www.goodreads.com/quotes/tag/uncertainty

Would you like these weekly financial recaps personally delivered to your email inbox? Sign up here: